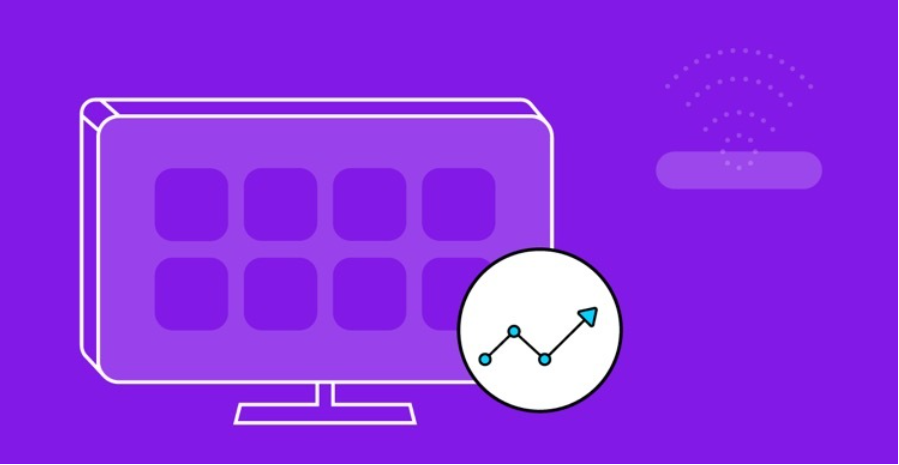

Investments are booming in CX. Not solely are extra organisations investing in CX software program for his or her enterprise operations, however there’s an entire net of investments occurring within the CX software program market itself. In reality, Allied Market Analysis simply launched some figures on how the CX software program market is performing. In response to the report, ‘the worldwide buyer expertise administration software program business was pegged at $7.57 billion in 2019, and is anticipated to succeed in $23.83 billion by 2027’. So the place’s all that cash going? Who’s shopping for out who? What’s driving these CX software program acquisitions? And what does this imply for customers of those CX options? Let’s discover out.

Table of Contents

- Customer Experience

- guaranteed android ranking

- aso world review

- googleplay keyword tool

On this article, we are going to define the greatest CX software program acquisitions in 2021.

What’s driving acquisitions within the CX area?

Final yr Mopinion revealed the State of CX 2020, figuring out some causes behind why there was a lot motion (each enlargement and consolidation) going down amongst CX software program options. So what’s up this yr?

For starters, the CX market has managed to take care of an amazing quantity of development and recognition in 2021; a development which took off virtually immediately after the beginning of the pandemic. Should you recall again in 2020, organisations have been abruptly pressured to shift their focus in the direction of offering higher digital experiences and subsequently implement applied sciences that might assist them obtain these objectives and that is nonetheless ongoing.

The one distinction is that now with all of this success out there, the degree of funding has gone up.

We’re nonetheless seeing loads of ‘crowding’ and smaller scale firms concentrating on a ‘slice of CX’, however there has additionally been fairly a little bit of motion among the many bigger CX suite software program – essentially the most notable of that are acquisitions made by Qualtrics and Zendesk. Our guess is that the latter is probably going the results of a flourishing business which – as beforehand talked about – has introduced fairly a bit of money and funding funding to the CX area.

This shift might additionally point out that these bigger organisations have recognised the significance of options comparable to consumer suggestions and are actually keen to spend extra on including most of these options to their digital portfolios.

So let’s atone for the newest adjustments within the CX market in 2021.

Newest Acquisitions within the CX Software program Market

Listed below are the newest actions within the CX area.

Confirmit / FocusVision / Dapresy rebranded below Forsta

March 2021 – Forsta, an expertise and analysis tech platform – which has been labeled ‘the brand new frontier of buyer expertise and analysis know-how’ – was the rebranded title below which firms Confirmit, FocusVision and Dapresy function. This newly melded model will present a variety of software program and options for CX and analysis. In response to the press launch, it additionally guarantees ‘instruments easy sufficient to deploy in days, highly effective sufficient to tailor to your precise wants’.

Thomabravo acquired Medallia

July 2021 – Thomabravo, a number one software program funding agency, acquired Medallia for six.4 Billion USD in a deal that can shut by the top of this yr. A famend buyer expertise firm, Medallia makes use of trademarked synthetic intelligence and machine studying know-how to disclose predictive insights that drive enterprise actions and outcomes. Medallia went public in 2019, however with this acquisition will now revert to a personal firm.

Qualtrics acquired Clarabridge

July 2021 – A buyer suggestions evaluation resolution, Qualtrics’s acquired Clarabridge, one of many leaders in omnichannel conversational analytics, in a inventory transaction valued at 1.125 billion USD. An award-winning platform, Clarabridge was a extremely engaging acquisition goal for any vendor in search of to leapfrog the competitors and obtain sustainable differentiation.

Vespa Capital & Feefo merged with Reevoo

September 2021 – Vespa Capital portfolio firm and buyer expertise (CX) and insights enterprise Feefo merged with Reevoo, the patron opinions & suggestions platform. With Vespa Capital as the bulk proprietor, each Feefo and Reevoo are nicely established SaaS platforms throughout many worldwide markets. Tony Wheble, CEO of Feefo, commented, “The 2 companies have complimentary shopper portfolios and share a standard set of values, most notably the place verified buyer suggestions and actual knowledge integrity are on the core of what we each do.”

Contentsquare acquired Hotjar

September 2021 – Contentsquare, the worldwide chief in digital expertise analytics, introduced that it’s becoming a member of forces with Hotjar, a number one product expertise insights platform within the SMB market. This acquisition will lend Contentsquare’s superior know-how and assets to Hotjar, whereas Contentsquare will profit from Hotjar’ attain and product-led method.

Verint acquired Conversocial

September 2021 – Conversocial, a frontrunner in conversational buyer expertise (delivered over messaging channels), was acquired by Verint for 50 million USD. Verint is a pure-play customer-engagement firm that’s increasing its cloud platform capabilities to assist manufacturers speed up digital-first buyer engagement.

Zendesk acquired Momentive

October 2021 – Zendesk, a software-as-a-service firm and Momentive, an expertise administration firm, have entered into an settlement below which Zendesk will purchase Momentive, together with its well-known SurveyMonkey platform. CEO Mikkel Svane says that the acquisition will allow Zendesk clients to “construct extra significant relationships” by offering alternatives to cross-sell and co-develop present and future merchandise.

Forsta partnered with Lumoa

November 2021 – Forsta was on a roll this yr, later asserting its partnership with Lumoa, an AI-powered perception platform. Forsta built-in the Lumoa platform into its expertise platform, giving customers extra superior AI-driven analytics; which appears to be a ‘must-have’ performance this yr.

Huge fish versus little fish

As you’ll be able to see, 2021 has seen some ‘huge fish’ mergers in addition to just a few small, however impactful acquisitions among the many ‘smaller fish’.

The query is, what is going to customers need this yr in the case of a CX resolution? Will it suffice to have one single CX suite dealing with all CX knowledge assortment, evaluation and activation actions? Or will customers need to create their very own CX tech stack utilizing a wide range of integratable CX software program? Will or not it’s better of breed or better of suite…

One fascinating commentary is that this yr’s 2021 Stackie Awards, an annual contest – hosted by MarTech – that challenges firms to visualise their martech stacks…

Yearly this occasion brings numerous digital-first organisations collectively to get insights into the several types of advertising and marketing know-how stacks utilized in apply. And apparently sufficient, yearly this awards convention appears to show that the proper advertising and marketing stack doesn’t exist. In different phrases, an all-encompassing CX suite may not essentially be the very best method, however moderately, extra organisations choose choosing and selecting their options for a tailor-made deck of instruments.

The Way forward for the CX House

Throughout these unprecedented instances, it’s important for CX leaders to not solely perceive what clients worth, however to additionally method buyer journeys with a exact and agile mindset. Solely by repeatedly optimising the client journey will these leaders have the ability to meet the ever-evolving wants of their clients.

That being stated, as we glance in the direction of the long run, we predict there can be many extra adjustments within the CX with a number of elements coming into play comparable to an elevated emphasis on agility, AI & instantaneous gratification and prescriptive personalisation. See the State of CX in 2021 for extra on these traits.

And if we take a look at the actions over this previous yr, we will in all probability additionally count on loads of innovation within the space of conversational buyer expertise (see Verint and Conversocial acquisition) in addition to a concentrate on constructing higher relationships with clients.