The revolution within the FinTech trade has fully modified the world of commerce. You don’t have to face within the lengthy queues exterior banks to pay the payments or deposit and withdraw cash. All due to banks creating cellular banking apps, you are able to do all such duties from cellphones throughout 2022.

Table of Contents

- CREATING MOBILE BANKING APPS

- keyword installs for ios apps

- ios keyword install

- google play store aso

These days, paying utility payments, transferring cash, checking financial institution statements, and even opening financial institution accounts is feasible from the house’s consolation. You may carry out all monetary operations with distinctive options in cellular banking apps with few clicks on cellphones. Banking purposes are additionally serving to customers in card-less ATM money withdrawal and deposit in superior nations.

Cellular banking apps and web banking providers have turn into the entrance door to banking operations globally and within the USA. Talking of 2022, digital banking has turned essential for each banks and customers around the globe. As most customers do monetary transactions on-line and over cellular, so growing a banking utility gives a aggressive benefit.

We acknowledge all of the happenings on the planet of banking and the progress within the FinTech trade. Digital expertise and smartphones are additionally revolutionizing the banking sector. This information will clarify that creating cellular banking apps will provide help to in serving extra customers.

Causes for the rise in utilization of Cellular Banking Apps

Firstly, it is very important talk about why clients are utilizing cellular banking providers greater than utilizing conventional banking providers. The reply to this query may be very easy. Individuals don’t need to stand within the lengthy queues to entry banking providers. As they’ll make the most of all these providers from the consolation of their properties by cellular banking.

Until April 2020, 70% of consumers from the highest 4 banks of the USA used cellular banking apps. Sure, this important improve within the utilization of digital banking surged due to COVID-19. However digital banking adoption is rising for the previous a number of years.

Customers are embracing digital banking as a result of technological development. The extraordinary efforts of android and iOS app builders are additionally reworking conventional banking. Modernization of the banking course of is mutually useful for each clients and banks.

Now let’s talk about some causes that inspire clients to make use of cellular banking apps.

- Single platform for every thing Banking

- Quick Cash Transfers

- 24/7 Banking Providers and Assist

- Lowering the Time and Value for Customers

Causes for the rise in utilization of Cellular Banking Apps

These causes are additionally encouraging the banks in direction of creating cellular banking apps amid 2022.

Single platform for every thing Banking

A single highly effective app that covers all banking providers solves many issues. Likewise, trendy cellular banking apps carry all banking duties to your fingertips. For instance, paying payments, purchasing on-line, transferring funds, accessing financial institution statements, and so forth.

Quick Cash Transfers

Cellular banking apps help speedy transactions as customers can switch cash simply. Whether or not you do native funds switch or worldwide cash switch, the method takes solely a few minutes. Banking purposes allow clients to ship cash to anybody around the globe in a really brief interval.

24/7 Banking Providers and Assist

Clients can do banking duties with cellular banking apps, for nonstop 24 hours a day, and seven days per week. Not like conventional banking providers, that are offered to customers for a restricted variety of hours and 5 days per week. Clients can entry cellular banking purposes at any time and on the transfer from anyplace they’re.

Your app should be capable to present the shoppers with 24/7 help. The queries of consumers will be solved by on-line customer support representatives or conventional cellphone help. Equally, utilizing chatbots pushed by AI is taking buyer help to the following stage.

Lowering the Time and Value for Customers

One of many main inspirations for growing utilization of cellular banking apps is that they reduce the transaction time brief. Since clients will not be required to go to the brick and mortar department of a financial institution.

Cellular banking purposes are additionally cost-effective. As a result of no costs are taken by banks for on-line providers, as they’re fully free. Equally, this additionally results in the discount of prices for banks as nicely.

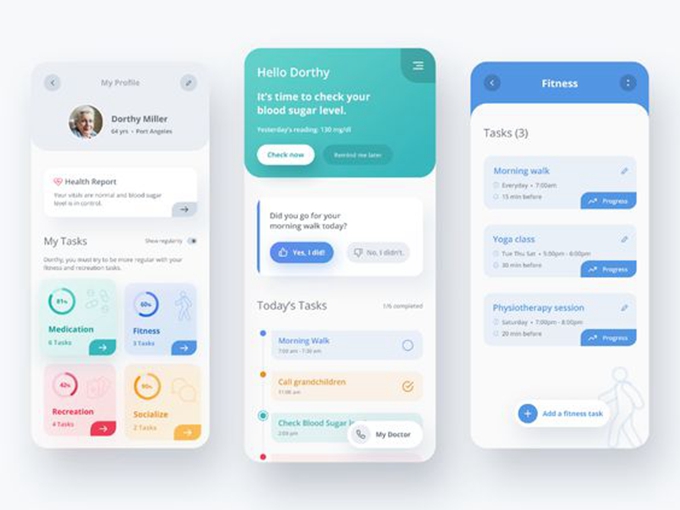

Options to equip Cellular Banking Apps with

In case, you’re constructing a cellular banking utility and need to give it a contemporary contact. Then, listed here are some options which you should load your app by 2022.

- Fundamental Banking Operations

- Push Notifications

- Debit/Credit score Card Administration

- Offline Cellular Expertise

Fundamental Banking Operations

That is the easy set of options that cellular banking apps should provide to the shoppers. It consists of stability checking, funds switch, on-line funds, and cellular top-ups, and so forth. This characteristic might be the very first thing clients undergo after they use the app for the primary time.

Push Notifications

That is one other basic characteristic that cellular banking apps should present to customers. The app ought to be capable to notify clients when their account is debited or credited. This may additionally warn customers in case of a fraudulent monetary transaction.

Debit/Credit score Card Administration

Immediately, the globally growing cashless buying pattern signifies that debit/bank card administration must be important in cellular banking apps. Clients ought to be capable to activate their fee playing cards or block them in case they get misplaced. Card administration additionally consists of setting fee limits and switch of playing cards to a different account.

Offline Cellular Expertise

This characteristic provides worth to cellular banking apps. It will be nice in case your banking utility works offline or in a poor web connection. This can guarantee that you would be able to facilitate extra customers and in all circumstances.

Methods to make Cellular Banking Apps profitable

Programming banking utility will not be a simple activity to carry out as issues may get tough. Whereas growing a fintech utility, you should be sure that your platform is reliable to hold out monetary transactions. Listed below are some factors which you should take care of to make sure the success of the cellular banking apps.

- Prioritizing Safety

- Offering Ease of Use

- Testing the Cellular Banking Apps

Prioritizing Safety

Empowering cellular banking apps with safety protocols is essentially the most essential stage. Banking purposes should be capable to maintain the client knowledge secure and safe. Guarantee that the app is secure from the attain of hackers and knowledge breaches.

This manner clients can function the appliance in a risk-free surroundings. Options like fingerprint and FaceID sign-in can enhance the safety of the funds. Investing in security measures drastically will increase the belief of your financial institution’s customers.

Offering Ease of Use

To make sure the success of your banking utility, it must be user-friendly with none complexities. The applying you develop should have a motive to supply the very best consumer expertise. Therefore, immense significance must be given to the UX design course of whereas creating cellular banking apps. A UX must be interactive that holds the facility to achieve buyer loyalty and appeal to extra customers to the app.

Testing the Cellular Banking Apps

If you end up growing a banking utility, there isn’t a room for errors. That’s why it’s necessary to check all of the options earlier than launching the cellular banking apps. With testing the appliance, it must be maintained and up to date once in a while. Due to this fact, take notice that high quality assurance is an ongoing course of in terms of digital banking.

Value of constructing Cellular Banking Apps

The price of creating cellular banking apps relies on the geographical location you’re getting the answer coded. So, the event value varies from nation to nation. It additionally relies on the app improvement firm you select.

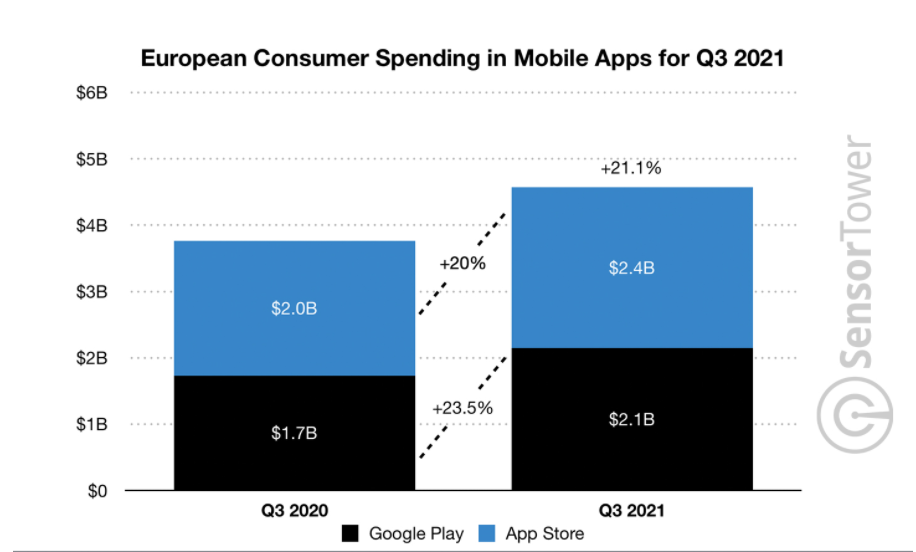

Until 2017, the world’s 15 prime banks had consumed $79 million on the institution of about 606 banking purposes. These are whopping bills by any estimate. However the rewards you get within the type of return on funding (ROI) are additionally nice.

You may cut back the worth of making cellular banking apps in a number of methods. Making a flutter app as a substitute of separate native apps for android and iOS is an choice. Furthermore, outsourcing the banking utility is one other cost-saving resolution.