The latest upheaval surrounding China’s cellular gaming market has prompted fairly a stir within the business and has left publishers and advertisers with questions in regards to the future progress of their apps. Whereas hypothesis is warranted, many non-gaming advertisers underestimate the huge person pool that presents itself with non-gaming apps and the alternatives which can be ripe for the taking. It’s simple to miss lots of the non-gaming app genres however their reputation continues to skyrocket in China even after the latest privateness rules and pandemic restrictions.

Table of Contents:

- China’s app market

- guaranteed ranking

- google play keyword optimization

- android keyword installs

China’s 2020 COVID restrictions ushered in an enormous array of latest buying, utility and social apps and present apps made some extent of including extra options at an unbelievable tempo. The expansion of the non-gaming app market additionally elevated person acquisition competitiveness and gave Western publishers a singular alternative to proceed progress in occasions of uncertainty with gaming apps. Opposite to standard perception, China truly has a decrease barrier to entry for a lot of non-gaming apps than numerous Western nations. Nonetheless, whereas getting into could be comparatively simple, person adoption and progress nonetheless requires an excellent understanding of what works and what doesn’t.

In response to Reyun, China’s largest cellular measurement platform, there have been 4,600 non-gaming apps working UA campaigns throughout the first half of 2021, rising by 45% from 2020 . That is excellent news for advertisers, given China’s predilection in the direction of ad-monetized fashions for non-gaming apps. With over 2,000 new apps all through the varied app shops, it’s obvious advertisers have absolutely regained confidence in the entire market and never simply cellular gaming.

Utility

Utility apps particularly had been an actual success story over the previous 18 months. Information supplied by Reyun noticed utility apps take nearly 1 / 4 of non-gaming cellular advertisements. China’s utility app market is overwhelmingly pushed by in-app advert monetization and has turn into a go-to style for manufacturers trying to promote associated merchandise and apps.

Utility apps don’t get a lot shine, maybe as a result of their predictability. China, nonetheless, has seemed to innovate the business, partially because of the lack of strict rules seen in gaming and social. Main the cost is picture modifying apps and international builders have been significantly profitable right here. Israeli developer, Lightricks, as an illustration has seen huge progress in China with its fan-favorite picture modifying app, FACETUNE2. The app persistently ranks within the high 5 and is a mainstay promotional app amongst the nation’s high influencers.

eCommerce and Buying

Additionally it is no secret that buying apps maintain vital significance to Chinese language customers and entrepreneurs alike. The latest bump within the person acquisition market could be, partially, because of the huge buying holidays seen in China equivalent to Alibaba’s mid-year 6.18 competition. China’s second-largest buying competition continues to interrupt data for gross sales and customers and is an efficient signal for the continued progress of the vertical. Chinese language eCommerce apps like Taobao and JD.com have seemingly damaged each buying document you would consider and the newest numbers present there are not any indicators of slowing down.

Many manufacturers now have a stable footing within the Chinese language market and are determining their methods for achievement. As with different markets, the artistic technique has turn into more and more extra essential and international manufacturers in China have been succeeding. Information from Reyun reveals that throughout the 6.18 buying competition each Taobao and JD.com noticed a major improve of their promoting quantity with JD putting a million artistic teams every day main as much as the competition.

The vast majority of these advert creatives proceed to be single-image codecs. It’s attention-grabbing to see a considerably outdated advert format maintain its floor on the earth’s largest eCommerce market. Pinduoduo, a comparatively new however fast-growing eCommerce app is, nonetheless, trying to break this establishment by incorporating video creatives as a vocal minority for advertisers. At 12% of complete quantity, video creatives have plenty of potential for buying apps significantly for merchandise that require tutorials or an additional push from native influencers.

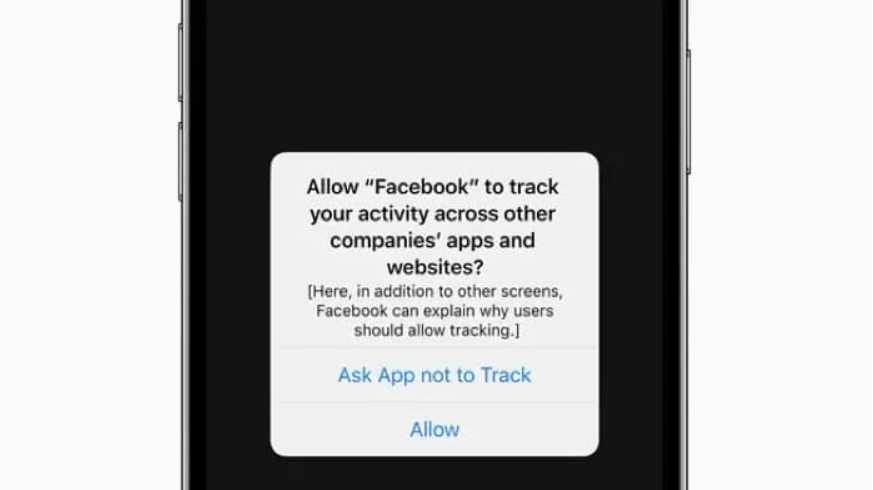

The genres with much less steam

Advertisers, nonetheless, have not too long ago been much less bullish on social person acquisition. China has not too long ago been implementing extra rules and app compliance for the burgeoning social market. Elevated hypothesis on the longer term has prompted lots of the social giants to concentrate on different app genres. It’s tough to say what the longer term would possibly maintain however it’s secure to presume many of those builders have sights on creating a full suite of apps to be able to diversify their danger.

Maybe the largest loser of the non-gaming app market has been schooling apps. On-line schooling has historically been large enterprise in China. The primary half of 2021 noticed Chinese language regulators not too long ago undertook in depth regulatory efforts concentrating on the web schooling sector. Because of the shift in coverage, advertisers have shifted their budgets and the drop-off has been dramatic.

Journey apps maintained a excessive progress fee, partly because of the general restoration of China’s journey business this 12 months. Throughout H1 2021, the web journey business was capable of regulate its advertising technique in time to satisfy customers’ wants. In response, the journey business made fast changes to promote native holidays to the market, pivoting away from worldwide journey. Advertisers started pivoting messaging and promoted Spring Competition as a time to ‘rejoice the New 12 months regionally’.

A lot has been mentioned about the way forward for China’s app market, and it’ll proceed to alter given the continued regulatory efforts. It’s clear, nonetheless, that there’s a comparatively steady and very affluent alternative for international non-gaming builders. The person acquisition market solely continues to extend as a complete and the flexibility to succeed in them is in the end dependent in your product and your capability to localize performance and advertising to the home market.