I simply tried PocketGuard, and it’s superior. Do you need to know why? I’m an over-spender, which has helped me tremendously in determining efficient methods to take care of my cash.

Table of Content

It gives easy budgeting instruments to the client in order that they will make progress towards any form of monetary objective they might have.

PocketGuard is a budgeting app that permits you to consider your bills and report your transactions that can assist you preserve observe of your cash. You’ll be able to set targets, and it’ll merely observe your progress.

It helps to make clear your funds by way of calculations and makes suggestions relative to your objective. Some options are paid for, however total, the expertise is superb.

Maintain studying to grasp what you are able to do with PocketGuard, tips on how to use it successfully in addition to pricing, security, and different components you have to be cautious of whereas utilizing it.

How does PocketGuard Work?

The app first begins to personalize your account by factoring in details about you and linking your financial institution accounts to find out the essential sum of money you have got.

It then components different data and related tendencies to suggest what you need to do.

One other benefit of PocketGuard is the way it has the choice to sync with numerous monetary establishments for you to have the ability to handle your funds.

This may be fairly a tiresome course of with different functions, however I can attest that this isn’t the case right here, and every little thing works seamlessly.

After analyzing your knowledge, the app offers you customized suggestions based mostly in your actual targets within the short-term and long run.

Whether or not saving up for one thing or paying off an overdue debt, PocketGuard might help you obtain it.

You’ll be able to even have your spending tendencies offered in graphs, however a few of the options listed here are behind a paywall, so you’ll have to pay for the premium version to get to these, which I did.

They have been very useful in understanding my patterns, even in methods I didn’t know. I lastly understood that it was time to make a change.

Safety

As quickly because the discuss coming into bank card and financial institution data began, I turned involved about whether or not it was secure with this app.

So, I took a while to perform a little analysis and was happy to seek out out that PocketGuard has a 256-bit SSL encryption which is the kind of safety utilized by giant monetary establishments.

It additionally permits using codes and FaceID in your telephone, guaranteeing there isn’t a misuse in case your telephone falls into the fallacious palms.

Monitoring options

The app permits you to trace the issues that you really want. It’s going to additionally use on-line knowledge to find out the place you will get the most effective costs for the stuff you purchase. This might help save much more.

The app additionally offers an academic weblog the place customers can be taught vastly concerning the numerous dimensions of efficient cash administration.

On this part, I’ve to say one other paywall; this could possibly be thought-about an particularly helpful function for many individuals.

The app observes your subscriptions, compares them to your use, after which makes suggestions concerning the subscriptions that you’d be higher off canceling.

The one draw back is that it is a premium function.

One other function I want to point out is the pie-chart mechanism. It offers a breakdown of your total spending and could be helpful to look at how a lot of your total earnings is taken up by particular person issues occurring in your life.

This may show helpful in detecting areas the place you may make compromises and reduce to change into extra environment friendly.

The “In My Pocket” tracker

This function makes an attempt to interrupt down the sum of money you possibly can presently afford to spend utilizing a easy equation. The equation is:

Estimated earnings – upcoming payments – monetary targets – spending/funds = IMP (“In my pocket”)

If you begin to consider it, we rarely suppose this clearly concerning the bills we’ve to handle when enthusiastic about shopping for one thing.

So, this might help you determine what you need to do or, extra importantly, what you possibly can afford.

This tracker can be utilized with different options just like the debt payoff plan function. You’ll then be capable to divert the disposable cash into different causes so that you simply don’t find yourself spending any of it.

Pricing

The free model comes with numerous options, however after utilizing it for some time and transferring on to the paid model, I can safely say that the paid model makes the entire saving expertise even higher.

| Free | The free model is extra fundamental and doesn’t permit for bucketing or making targets. |

| Premium | When you determine to go for the paid model, you get a number of extra options, together with prolonged transaction historical past retention, which might help you perceive your spending tendencies. You’ll be able to create targets and arrange plans to repay your debt. You may as well cut up up numerous bills into separate classes. When you improve from the free model to the premium, you may be offered with pricing choices. You may get a lifetime membership for $99.00 and a yearly membership for $79.99. If these choices appear extreme, you will get a month-to-month subscription, so you possibly can determine whether or not you’ll go for the opposite ones. This one is for $7.99. |

Professionals

- You’ll be able to hyperlink financial institution accounts from an extended record of acknowledged monetary establishments.

- Options are helpful for financial savings.

- Customizable plans for optimum cash efficiency.

Cons

- Some options are hidden behind the paywall, solely premium customers can entry them.

- The web site is a bit difficult and could possibly be extra welcoming to the customers.

Points with PocketGuard

Whereas the app’s total expertise is usually good, some folks report that generally the app doesn’t precisely categorize transactions, which may create issues every so often.

It could be required on a part of the consumer to go over the transaction historical past and confirm it to guarantee that nothing is missed or mistaken; this might show to be problematic.

However I confronted no such points or something related throughout my use.

How PocketGuard compares to others

The value of PocketGuard’s premium model is comparatively low in comparison with what it gives and the opponents’ pricing.

PocketGuard could be particularly helpful when managing budgets, particularly when you have multiple funds.

Once I in contrast it to different apps, I rapidly discovered that none of them have been as easy to make use of as this one.

That’s how I do know that that is most likely the one that will profit you essentially the most. The simplicity is what units it aside.

Who would profit essentially the most from PocketGuard?

When you’re somebody who want to have issues automated for you with minimal suggestions being made to you all through your spending, then this app is the one for you.

It could appear ironic that to really expertise this budgeting app, it’s important to pay extra for it, which is the alternative of what you’re making an attempt to realize from its use. However take it from me, your cash positively received’t go to waste.

Whereas most of the helpful and actually customizable options are hidden behind a cost wall, it could be a smart funding contemplating all the cash that you may find yourself saving because of this choice.

Conclusion

PocketGuard is a superb funding because it offers considerate instruments to save lots of your cash on the go, together with the flexibility to customise plans whereas contemplating your private monetary state of affairs.

It may result in a considerably higher high quality of life.

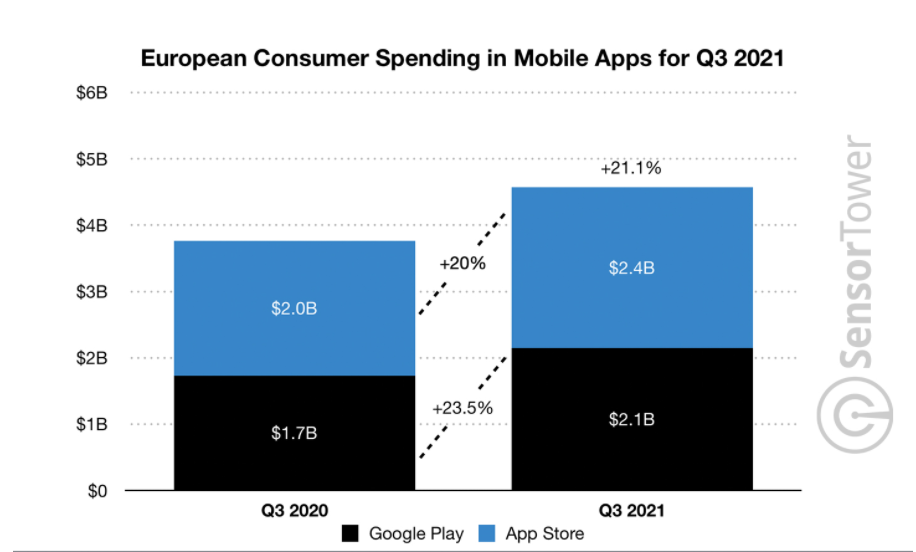

The app is presently rated 4.7 out of 5 on the App Retailer and three.7 out of 5 on Google Play. The app is usually advisable for cell use as a result of that’s how one can maximize its utility.

However should you’re extra of a pc particular person, don’t fear, it’s also accessible on the desktop.