The visible highway to turning into debt-free is a inflexible one. And with the difficulties you’ll expertise alongside the best way, it’s important that you’ve a few instruments that may make it easier to plan and make the method simpler. One class of instruments which have confirmed to be useful in managing debt is the debt payoff planner. You’ve the choice to pick out between a number of cell purposes. For me, Savvy Debt Payoff Planner is a top quality debt payoff planner.

Table of Content

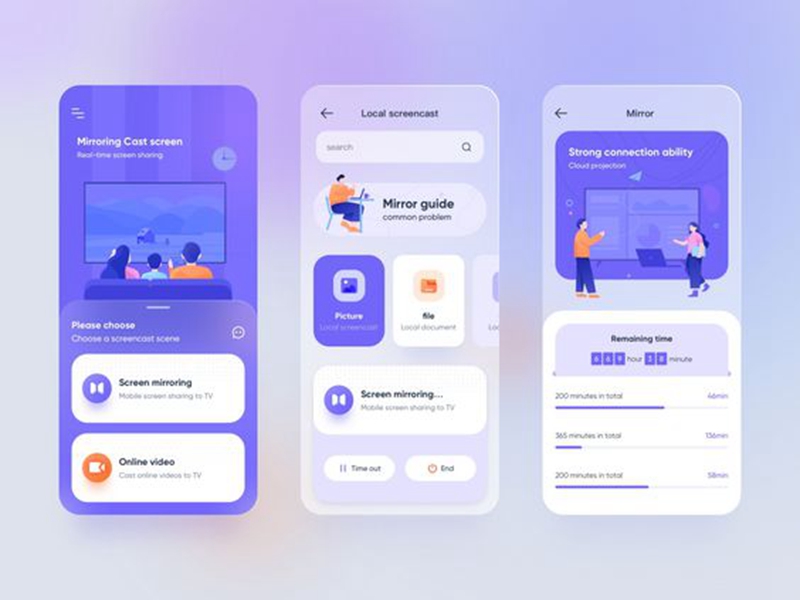

- Savvy Debt Payoff Planner

- app downloads buy

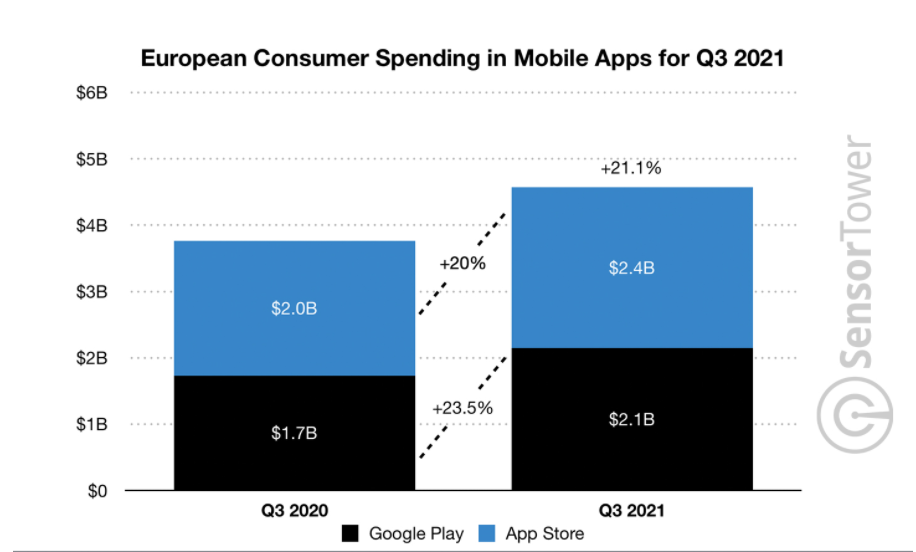

- app ranking ios

- android keyword search

Are you in search of the Greatest Debt Payoff Planner apps?

The perfect Debt Payoff Planner in could be certainlySavvy Debt Payoff Planner. This app is adeptly designed that can assist you repay all of your money owed and keep out of debt too. It could actually calculate, in your behalf, the neatest option to make month-to-month funds. And, one of the best half is, it’s user-friendly.

Primarily it saves the common consumer over $2,000 utilizing the Savvy debt payoff methodology versus the Snowball debt payoff methodology. Savvy is ad-free and makes use of automation to make your life less complicated. It’s sensible and affords good judgments about repay your money owed higher to attain debt freedom as soon as and for all.

Final Savvy Debt Payoff Planner Myths Defined

Savvy conveys to you what you pay and the way a lot to pay in the direction of every of your money owed every month. As soon as your minimums are paid, Savvy will inform you the place to place the additional cash. The common consumer could save over $2,000 by utilizing Savvy even after the month-to-month price in comparison with utilizing a debt payoff planner utilizing the Snowball methodology primarily based on a current research.

Savvy was constructed utilizing the proprietary Savvy debt payoff methodology. It’s not the snowball methodology or the avalanche methodology. As a substitute, the Savvy debt payoff methodology offers the psychological profit from the Snowball methodology and the curiosity financial savings of Avalanche. It saves the common consumer over $2,000; you get out of debt quicker. They shave a few months off of your debt freedom date collectively.

Pricing

For a restricted time, attempt the Savvy app at no cost for 30 days adopted by a month-to-month subscription of $5.99 (discounted from $9.99).

Issues You Must Know About Savvy Debt Payoff Planner

It permits customers so as to add their accounts manually or mechanically. Furthermore, Savvy is designed to serve the busy inhabitants by allowing you so as to add your accounts mechanically by giving read-only entry to view transactions by way of your checking account. If folks cautious about safety and/otherwise you’d like to manage the method, you may also add your accounts and your transactions manually.

As well as, Savvy protects your transaction data with read-only entry and bank-level safety by way of your monetary establishments. Your knowledge is protected which implies it isn’t shared with third events. Ascend connects to US monetary establishments solely.

Last Feedback

Private finance expertise has come a good distance. We’ve gone from utilizing tax calculators to finances spreadsheets and now cell apps. Fortuitously, the Savvy Debt Payoff Planner app has one of the best options to help you. You will note why it ranked #1 because the Greatest Debt Payoff App. As well as, you may also use this app to resolve which debt it’s best to goal to repay first.