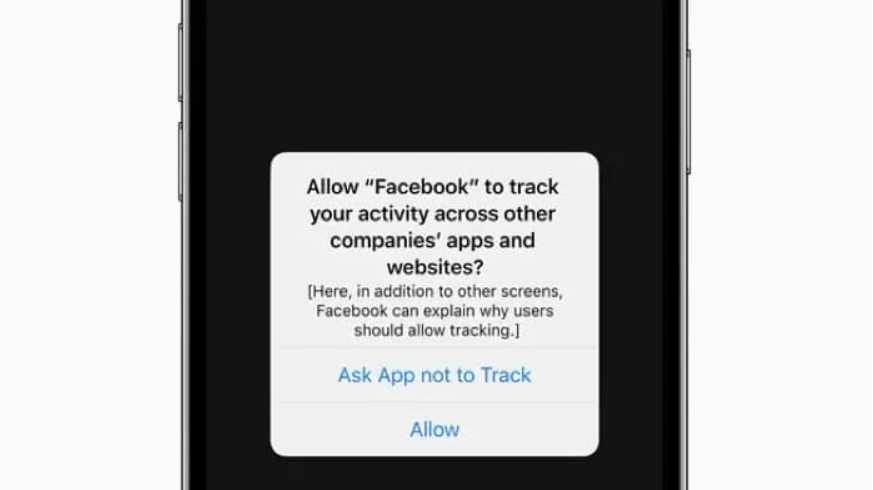

On this present day, Apple started implementing its App Monitoring Transparency (ATT) framework in iOS14.5, requiring apps to actively achieve person consent for monitoring by way of an opt-in mechanism, ushering in a brand new privateness period.

Table of Content

- mobile app marketing

- increase keyword ranking in app store

- buy real ios app installs

- ratings and reviews app store

Whereas it was actually a welcomed transfer so far as client privateness was involved, ATT created a large problem for cellular app entrepreneurs. All of the sudden, knowledge was principally restricted and aggregated, turning person level-driven measurement and optimization the wrong way up.

The tremors had been felt throughout the ecosystem: from app entrepreneurs, via media sources and advert networks, to cellular attribution and measurement suppliers.

How did ATT influence the variety of downloads pushed by advertising and marketing? Is remarketing nonetheless a viable advertising and marketing exercise? How did funds allocation change, and what has been the impact on client spend in apps?

To handle these questions, our annual High 5 knowledge traits report analyzed over 60 billion app installs in 2021, permitting us to foretell what 2022 will deliver because the business continues to adapt to the brand new privateness paradigm.

Click on on the next hyperlinks and again to navigate within the publish:

1) Installs: Advertising and marketing measurement capabilities largely retained following preliminary post-iOS 14.5 plunge

2) Budgets: Apps spent $78-$83 billion on person acquisition in 2021 – up 40% YoY

3) Re-engagement: Paid remarketing innovation drives iOS rebound whereas owned media rises by 45%

4) Income: Gaming reliance on advertising and marketing highlights its monetization challenges within the privateness period

5) iOS 14.5+ deep dive: ATT opt-in charges & SKAN conversion worth mapping

BONUS: YoY development per class and nation reveals Finance is on tear

All knowledge used within the report is measured, the advertising and marketing measurement and expertise platform. That is completed by way of integrations with main media companions, in addition to its proprietary SDK applied in its purchasers’ apps. All knowledge is nameless and aggregated.

1) Installs: Advertising and marketing measurement capabilities largely retained following preliminary publish iOS 14.5 plunge

A lot has been stated about how COVID-19 considerably accelerated digital transformation in 2020.

Including to the digitalization development, our knowledge reveals {that a} new regular has additionally been created on the planet of cellular apps, with your complete set up and utilization baseline elevated in 2021, as we will see within the following chart.

A year-over-year comparability has 2021 installs exceeding 2020 by 19%. That is fairly a feat contemplating 2020 with its lockdowns and social distancing insurance policies that generated a 33% leap in comparison with 2019.

Enhanced digital consumption of cellular gadgets in 2021 was a terrific start line for the cellular app area.

However on April twenty sixth, Apple’s iOS 14.5 modified how the [marketing] sport was performed.

As seen above, general app installs climbed, which could be simply measured. The issue of magnitude was, initially, the problem to measure non-organic installs (NOIs) and dedupe knowledge from a number of sources:

- SKAdNetwork (SKAN):Attribution carried out on the machine itself by Apple’s privacy-centric attribution mechanism.

And conventional attribution carried out for:

- ATT-consented customers:Attribution primarily based on ID matching. It’s price mentioning that though consent charges had been larger than anticipated, nearly all of customers couldn’t be attributed with ID matching because it requires twin consent (extra on that additional down).

- Non-consented customers:Attribution primarily based on aggregated fashions – Aggregated Superior Privateness framework for paid media or probabilistic modeling for owned media.

- Older variations customers:Those that have but to improve to iOS 14.5+.

To dedupe, we used the very best worth of NOI per media supply and marketing campaign in every measured week, which explains why the general determine is decrease than the sum of conventional and SKAdNetwork knowledge.

Initially, conventional attribution took successful, dropping 25% by June twenty first after which an extra 5% by mid September. On the SKAN facet issues weren’t trying higher early on both, with gradual adoption and implementation amongst advertisers and media firms alike.

Whereas SKAN site visitors began climbing in July, conventional attribution remained low. Over time, nonetheless, innovation began kicking in as we invested vital assets in various and privateness compliant measurement.

Clearly, successful credit score for NOIs this 12 months has been powerful for iOS entrepreneurs, with an general 5% drop (whereas Android NOIs elevated 15%).

However:

Within the final couple of months, conventional attribution picked up pace, rising by 17%. With the continued adoption of SKAN, measurement capabilities have been largely retained with the variety of attributed NOIs nearing pre-iOS 14.5 ranges.

Gaming adopts SKAN however takes successful resulting from its reliance on advertising and marketing

On the vertical entrance, we will see that Gaming apps, recognized for his or her knowledge savviness and agility, have adopted SKAN a lot quicker than non-gaming apps with 67% of NOIs vs a mere 30%.

However a view from above reveals that knowledge limitations and measurement shifts have taken a toll on Gaming apps. Primarily based on evaluation of over 100 billion installs since January 2020, we will see a 6% YoY drop in general Gaming app installs in 2021, whereas on the similar time non-gaming apps loved a 25% leap.

Due to the large competitors video games face and the truth that branding performs a a lot smaller function on this vertical, Gaming is much extra reliant on advertising and marketing. In actual fact, Gaming app entrepreneurs have typically handled non-organic customers as of upper high quality than natural customers as a result of they excel at person acquisition that’s primarily based on user-level indicators.

Nonetheless, reliance on person stage knowledge additionally signifies that they’re extra uncovered to adjustments in how knowledge is measured and optimized. With the shift in the direction of combination measurement, general set up numbers in Gaming have dropped – principally the results of a decline in marketing-driven installs.

What’s in retailer for 2022

Because the business continues to adapt to the brand new privateness norm, the power to measure, attribute, and optimize advertising and marketing actions will proceed to enhance on iOS (and on Android when Google introduces its personal privateness measures).

Enhancements will likely be pushed by higher and extra subtle fashions, elevated utilization of predictive analytics, acquired experience in SKAN – significantly optimizing conversion values (see additional down for extra on the subject), and throughout innovation throughout the ecosystem.

We are able to solely hope that Apple will add extra privateness compliant knowledge to SKAdNetwork, significantly much-needed natural knowledge, GEO stage info, deferred deep linking, and knowledge from web-to-app and remarketing campaigns.

2) Budgets: Apps spent $78-$83 billion on person acquisition in 2021 – up 40% YoY

Consumer acquisition budgets in 2021 will attain $78-$83 billion, with the vary pushed primarily by funds estimations in China (see finish of article for extra on our methodology). The determine represents a 40% YoY enhance pushed by a 50% leap in Android and 26% rise in iOS.

Whereas spend elevated on each platforms, the explanation behind the expansion in every OS was completely completely different.

As defined above, iOS noticed fewer NOIs this 12 months (-5%). On the similar time, iOS additionally skilled a major rise in efficient value per set up, which drove budgets upward. Advert costs elevated by 20% to as a lot as 50% throughout almost all classes because the enforcement of iOS 14.5!

What this implies is that entrepreneurs had been in a position to purchase and get credit score for a lot fewer customers for a similar funds they’ve invested in 2020, or – needed to enhance their spend for a similar quantity of customers.

Why did media grow to be so costly on iOS?

For starters – fundamental provide and demand. The costs for a a lot decrease provide of consented customers leaped as demand for customers with full knowledge granularity has skyrocketed for apparent causes.

However it seems that the primary trigger for this leap in value has been the inefficiency of main media sources throughout a time of transition to focus on the appropriate individuals and estimate the appropriate influence.

It’s more durable to make small segments of high-value customers, so entrepreneurs want to make use of broader focusing on, which additionally makes it much less related.

On high of that, networks can’t optimize towards in-app indicators but, though this functionality is being developed with options comparable to Google’s GBRAID and Fb’s AEM; till they do, their focusing on and optimization talents are negatively affected.

In parallel, demand for Android with its full knowledge granularity surged with NOIs rising over 40% YoY, particularly in Gaming the place NOIs leaped 50% in comparison with non-gaming at a nonetheless spectacular 36%. Curiously, international Android CPI in Gaming was down 11% this 12 months (it did enhance 23% in North America, however dropped 24% and 15% in Southeast Asia and Japan & Korea, respectively), whereas non-gaming CPI elevated by nearly 20%.

As proven in our newest Efficiency Index that features the primary SKAN rating, budgets haven’t solely shifted to Android, they’ve additionally shifted amongst media firms. TikTok Adverts got here out on high of the SKAN Index whereas Fb ranked 2nd.

The social large additionally misplaced its dominant place in iOS amongst consenting customers to Apple Search Adverts (ASA). The truth that ASA has its personal API and is ready to preserve full knowledge granularity has attracted extra budgets to this platform.

What’s in retailer for 2022

Consumer acquisition budgets will proceed to rise with extra NOIs on each platforms. Nonetheless, the price of media received’t enhance as a lot in iOS this 12 months given the estimations that the inefficiencies on the community facet will likely be largely solved.

Complete business UA spend methodology

The system combines three buckets:

- Budgets measured by one of many main cellular measurement companions (business huge extrapolation was made primarily based on third celebration estimates)

- The non-attributed market or advertising and marketing pushed installs that weren’t measured by one of many main MMPs (about 10% in keeping with estimates)

- Spend in China the place measurement is a far larger problem due do its fragmented app retailer area; we used App Annie’s complete of96 billion installs.

3) Re-engagement: Paid remarketing innovation drives iOS rebound whereas owned media rises by 45%

After a gentle climb lately, paid remarketing efforts by cellular apps plummeted as soon as iOS14.5 was launched. This was anticipated – with out IDFA, focusing on and personalization, that are the premise of remarketing, can’t work.

From March to July, the variety of remarketing conversions plunged by nearly 35%, even though adoption of model 14.5 was gradual (solely 27% in June).

However then, as seen within the NOI development above, innovation kicked in – this time on Google’s facet. The search large launched GBRAID – an combination and privateness compliant identifier designed to optimize re-engagement campaigns.

As a result of Google is the biggest participant when it comes to sheer quantity inside the remarketing pie, the truth that it launched a brand new method to measure single handedly elevated the variety of remarketing conversions by 12% from July to September, and one other 14% in October as the vacation season kicked off (final 12 months, iOS remarketing elevated nearly 10% in October vs. September).

As with NOIs, Android capitalized on iOS challenges, rising its variety of attributed remarketing conversions all through your complete 12 months by a complete of over 45%.

Owned media on the rise in its place

With the challenges of remarketing in iOS, it’s no shock that the usage of owned media to re-engage present customers via push notifications, e mail, and in-app messages has jumped nearly 45% since April (in comparison with solely 17% elevate in Android).

Moreover, owned media provides apps full knowledge granularity inside a 1st celebration knowledge surroundings (privateness measures search to forestall the passage of knowledge to third events, not inside an organization’s owned properties).

Increasingly apps are utilizing built-in viewers segmentation and advertising and marketing automation instruments to assist app entrepreneurs effectively re-engage customers. This enables entrepreneurs to create tailor-made messaging, and even exclude customers who’ve already responded to a marketing campaign from seeing comparable advertisements throughout different owned channels.

What’s in retailer for 2022

Re-engagement will proceed to drive elevated utilization, each on the owned media 1st celebration knowledge facet, and the paid remarketing entrance – the place conversions will proceed to rebound as different networks are already engaged on options.

4) Income: Gaming reliance on advertising and marketing highlights its monetization challenges within the privateness period

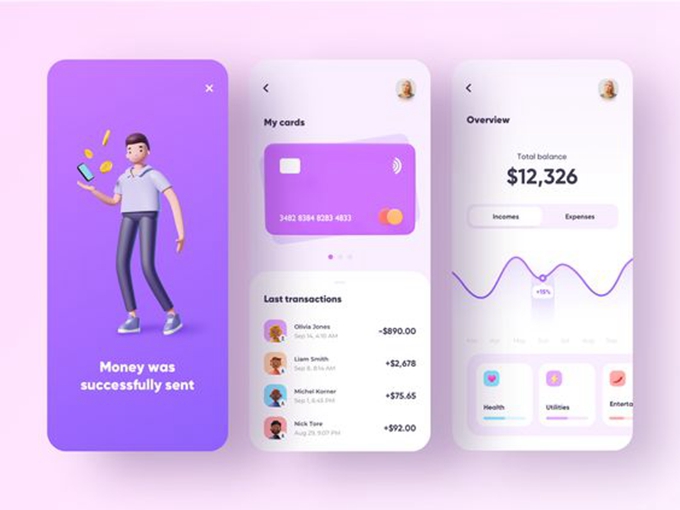

An evaluation of complete client spend (IAP or in-app buy income) in apps reveals simply how difficult iOS14.5 has been for Gaming apps.

As we solely evaluate apps that had been dwell all through your complete measured interval, income in Gaming often doesn’t enhance by a lot as many video games have a restricted shelf life.

Nonetheless, a comparability between platforms has Gaming IAP plunging 38% between April and September in comparison with a minor 13% drop in Android.

As mentioned in development #1, not like non-gaming apps, video games are closely reliant on advertising and marketing and their means to optimize primarily based on user-level knowledge indicators. For many customers, focusing on and optimization have been affected of their absence, resulting in a drop in general Gaming income from IAP.

The identical development is seen in IAA (in-app promoting) income on the publishing entrance, which is the opposite facet of the Gaming UA coin. Between April and September, iOS income dropped by 15%, whereas Android income jumped 45% throughout the identical timeframe.

Comparable platform traits had been seen amongst non-gaming apps which are pushed primarily by natural site visitors. We are able to see a rise in Might, after which a comparatively flat income trendline.

With October marking the beginning of the This autumn vacation procuring season, and November in full pace with Singles Day, Black November, and Black Friday gross sales, we will see the influence of Buying – the biggest non-gaming class – on the general development.

What’s in retailer for 2022

Gaming apps will discover a method to regulate to the out there knowledge and measurement methodologies. They’ve at all times been the quickest learners and are actually the perfect at data-driven optimization.

This time round, nonetheless, issues have been tougher as their reliance on user-level knowledge, and in addition the truth that the networks they depend on are additionally within the midst of their very own studying curve.

5) iOS 14.5+ deep dive: ATT opt-in charges & SKAN conversion worth mapping

The ATT immediate has single handedly modified a complete business and created fairly a dilemma for cellular apps. As a result of it’s an opt-in mechanism and a easy device to realize person consent, apps can select to not present it. In such a case, app entrepreneurs would accept SKAdNetwork attribution and probabilistic modeling.

The primary cause why some apps selected to not implement ATT is out of concern that the immediate with its considerably off placing language can drive churn and disruption to the person expertise.

However the actuality is that the advantages of exhibiting the immediate far outweigh the advantages of not exhibiting it.

Supporting this declare, we will see that six months after the discharge of iOS14.5, nearly 65% of apps applied ATT and we count on this quantity to extend to 70%-75% subsequent 12 months.

Why do most apps present the immediate?

Properly, we’ve seen ATT opt-in charges persistently attain 46% throughout the previous couple of months. Because of this in almost 1 in each 2 cases when a person truly sees a immediate, the ‘Permit’ button is tapped.

From a pure person expertise perspective, that quantity is sort of promising and reveals that many customers are keen to simply accept monitoring in return for a extra customized expertise.

Though there’s actually lots that may be completed to enhance opt-in charges, after we embody restricted customers and customers who enabled Restrict Advert Monitoring (LAT), the general price shrinks as Apple doesn’t enable the immediate to be proven to those segments.

Extra importantly, because it takes two to tango, ID matching can solely work if there’s twin consent on each the writer and advertiser facet, which suggests IDFA attribution charges are a lot decrease.

The underside line is that IDFA continues to be right here, and though it’s solely current in a a lot smaller cohort of customers, this group is extremely useful for benchmarking, modeling, and extrapolations on non-consenting audiences.

Conversion worth mappings present gaps between Gaming and non-gaming

The primary space entrepreneurs have been battling this 12 months was determining how one can work with Apple’s SKAdNetwork conversion worth mechanism.

Extra particularly, how one can profit from restricted knowledge; as a result of it’s the solely post-install knowledge that may be linked to their campaigns. Regardless of limitations, it’s paramount to get it proper.

What we will be taught by analyzing knowledge from Conversion Studio is that Gaming apps are laser-focused on income, and as such – it’s a mannequin that’s being concerned in most conversion worth schemes.

Their commonest configuration is Occasions & Income with 36%-48%, except Hyper Informal apps that favor occasions solely configurations (38%). A Income-only configuration can be highly regarded amongst gaming apps, with 18%-35% choosing this schema.

On the non-gaming facet, Occasions-only is essentially the most configured possibility, with Buying at 40%, Finance at 56%, Well being & Health at 58%, and Leisure at 57%.

For extra on how one can profit from conversion values, together with benchmarks on exercise window timer, and optimum utilization of the 64 mixture capability, click on right here.

What’s in retailer for 2022

Decide-in charges will proceed to enhance as customers will come to grips with poor person expertise they get from untargeted advertisements, whereas manufacturers will get higher at optimizing their prompts and offering a transparent worth alternate.

Nonetheless not completely satisfied? A brand new report by Gartner predicts that opt-in charges will enhance by over 150% by 2023.

As for conversion values, with time, data, testing, and coaching, entrepreneurs will nice tune their mapping and schemes to profit from the information that’s out there to them.

To sum up

2021 privateness adjustments have been nice for end-users and the necessary reason behind safeguarding their knowledge, but not-so-great for entrepreneurs.

However – issues are trying up as we head into 2022 and past:

- Continued learnings of SKAdNetwork, new Apple options, advert community options and innovation – will maximize SKAN’s worth

- Decide-in price optimization helps leveragedevice IDs from consenting customers – the place relevant – for the aim of modeling and benchmarking

- Privateness-preserving innovation will retain measurability (e.g. machine studying fashions, incrementality and so on.)

- Privateness-preserving knowledge collaboration inside the ecosystem primarily based on Knowledge Clear Room applied sciences will introduce a brand new and improved means of enabling advertising and marketing actions that may verify all packing containers:

- Consumer-level pushed insights in aggregated format for optimization

- Enhanced person expertise

- Safeguarded person privateness

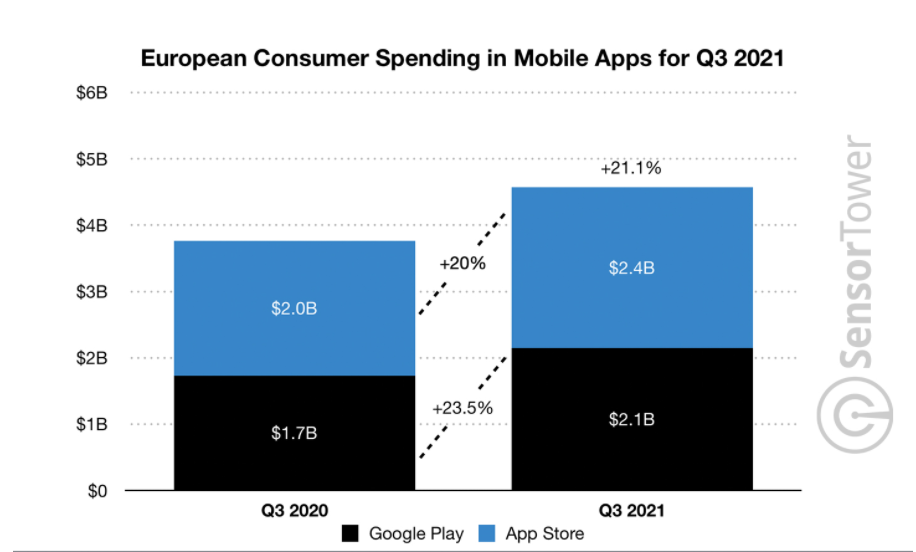

BONUS: YoY development per class and nation reveals Finance is on tear

A class comparability reveals us yet one more angle of simply how completely different iOS and Android are in 2021.

Adjustments in general demand for apps assorted considerably between the 2 platforms in nearly each class, particularly Relationship, Information, Buying, Finance, Well being & Health, and Gaming.

When it comes to pure development, as we’ve proven in our annual State of App Finance Advertising and marketing report, Finance is on a tear with the very best price in iOS and 2nd highest on Android.

Fintechs are in all places, serving to individuals to handle their private funds, put money into shares, handle digital wallets, fee strategies, cryptos, main a worldwide revolution on the connection between individuals and their cash.

Social and Buying have additionally proven spectacular development, whereas Gaming lagged behind due to losses on iOS (see above).

Growing markets drive development

A take a look at the world map reveals many hyper development markets with a 30% development price or larger within the growing world throughout Latin America (Peru, Mexico, Colombia, Brazil), the Center East (Iraq, Algeria, Egypt), Africa (Nigeria, South Africa), the Indian subcontinent (Bangladesh, Pakistan, Nepal) and Southeast Asia (Philippines, Indonesia).

Development within the US, on the flip facet, lagged behind in comparison with different markets, however nonetheless managed to drive elevated demand for apps (+10% YoY), whereas installs in one other mega market – India – grew by 14%.